Delve into the world of Small Business Liability Insurance Coverage for New Companies with this insightful guide that sheds light on the importance of protecting your business from potential risks and liabilities. As new ventures navigate the complex landscape of insurance, understanding the types of coverage available and factors to consider becomes paramount for their success. Let's explore how small businesses can safeguard their future with the right insurance coverage.

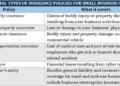

Overview of Small Business Liability Insurance

Small business liability insurance is a crucial protection for new companies, providing coverage against various risks and liabilities that may arise during business operations. Without proper insurance, new businesses are vulnerable to financial losses and legal issues that could potentially cripple their operations and reputation.Types of Coverage

- General Liability Insurance: This type of coverage protects businesses against claims of bodily injury, property damage, and advertising injury.

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage protects businesses from claims of negligence or inadequate work.

- Product Liability Insurance: This coverage is essential for businesses that manufacture, distribute, or sell products, protecting them against claims of bodily harm or property damage caused by their products.

Risks and Liabilities

Without proper insurance coverage, new companies face significant risks and liabilities that could result in financial ruin. For example, a customer could slip and fall in a retail store, leading to a lawsuit for medical expenses. Without general liability insurance, the business would be responsible for covering these costs, potentially leading to bankruptcy.

Similarly, a software development company could face a lawsuit for errors in the code that led to financial losses for a client. Without professional liability insurance, the business would have to pay for legal defense and potential settlements out of pocket, draining valuable resources.

Factors to Consider When Choosing Coverage

When selecting liability insurance for a new company, there are several key factors to consider to ensure adequate protection. It is essential to assess the specific needs and risks of the business to determine the most suitable coverage options available for small businesses.Business Size and Industry

- Consider the size of your business and the industry you operate in when choosing liability insurance. Different industries may have unique risks that require specific coverage.

- Smaller businesses may opt for a basic general liability policy, while larger companies with more complex operations may need additional coverage options.

Risk Assessment

- Conduct a thorough risk assessment to identify potential liabilities that your business may face. This can help determine the level of coverage needed to protect against specific risks.

- Factors such as the nature of your products or services, your location, and the number of employees can all impact the type and amount of coverage required.

Coverage Options

- Compare different coverage options available for small businesses, such as general liability, professional liability, product liability, and cyber liability insurance.

- Determine which policies best align with your business needs and budget constraints, considering both the coverage limits and deductibles.

Cost Analysis of Small Business Liability Insurance

When it comes to small business liability insurance, understanding the cost factors is crucial for new companies. Insurance premiums are calculated based on various elements that determine the level of risk associated with your business.

Factors Affecting Insurance Premiums

- The type of business you operate: Certain industries are considered riskier than others, impacting the cost of insurance.

- Business size and revenue: Larger businesses with higher revenue may face higher premiums due to increased exposure.

- Claims history: Past claims can influence the cost of insurance, with a history of frequent claims leading to higher premiums.

- Location: The location of your business can affect insurance costs, especially in areas prone to natural disasters or high crime rates.

- Coverage limits: The higher the coverage limits you choose, the more you can expect to pay in premiums.

Optimizing Coverage for Cost Efficiency

- Assess your risks: Identifying and prioritizing your business risks can help you tailor your coverage to focus on areas that need protection the most.

- Bundling policies: Consider bundling different types of insurance policies with the same provider to potentially save on costs through package deals.

- Review and adjust coverage: Regularly review your insurance needs and make adjustments as your business grows or changes to avoid overpaying for coverage you don't need.

Financial Impact of Inadequate Insurance

Not having adequate insurance coverage can have severe financial consequences for new companies. In the event of a liability claim or lawsuit, the costs of legal defense, settlements, or judgments can quickly add up and potentially bankrupt your business. It's essential to strike a balance between cost and protection to safeguard your company's financial stability.

Steps to Procure Small Business Liability Insurance

When starting a new company, it is crucial to secure small business liability insurance to protect your business from potential risks and liabilities. Here are the steps new companies need to follow to obtain liability insurance.

When starting a new company, it is crucial to secure small business liability insurance to protect your business from potential risks and liabilities. Here are the steps new companies need to follow to obtain liability insurance.Documentation Required During the Application Process

- Business Information: You will need to provide details about your company, including the nature of your business, number of employees, and annual revenue.

- Insurance History: If your company has had previous insurance coverage, you may need to provide details about your claims history.

- Financial Records: Insurers may request financial statements to assess the financial stability of your business.

- Property Information: If you are looking to cover your business property, you will need to provide information about the value and location of your assets.

Importance of Reviewing and Updating Insurance Policies

- Regular Review: It is essential to review your insurance policies periodically to ensure that your coverage aligns with the evolving needs of your business.

- Policy Adjustments: As your business grows, you may need to adjust your coverage limits or add additional coverage to adequately protect your assets.

- Consultation: Consider consulting with an insurance agent or broker to help you navigate the process of reviewing and updating your insurance policies.

Closing Summary

In conclusion, Small Business Liability Insurance Coverage for New Companies is a crucial aspect of ensuring the longevity and success of any budding enterprise. By taking proactive steps to secure the appropriate coverage, businesses can mitigate risks and focus on growth and development. Remember, investing in the right insurance today can safeguard your business tomorrow.

Q&A

What are the key types of coverage included in small business liability insurance?

Small business liability insurance typically includes general liability, professional liability, and product liability coverage.

How are insurance premiums calculated for new companies?

Insurance premiums for new companies are often calculated based on factors such as the type of business, coverage limits, location, and claims history.

What documentation is required to obtain small business liability insurance?

New companies may need to provide documents such as business licenses, financial statements, and information about the nature of their operations.